How can companies implement ESG strategies?

ESG (Environment, Social, Governance) strategies are no longer about compliance. ESG strategies are a momentum maker and vehicle for growth for your organization.

ESG strategies are not new but they are in a momentum moment as they are in the midst of going through an evolution.

Initially, ESG was primarily an investment strategy used to promote social responsibility. Investors and ESG funds excluded companies and industries based on criteria like involvement in “vices” (eg. tobacco and alcohol), controversial affiliations, and being bad for the environment.

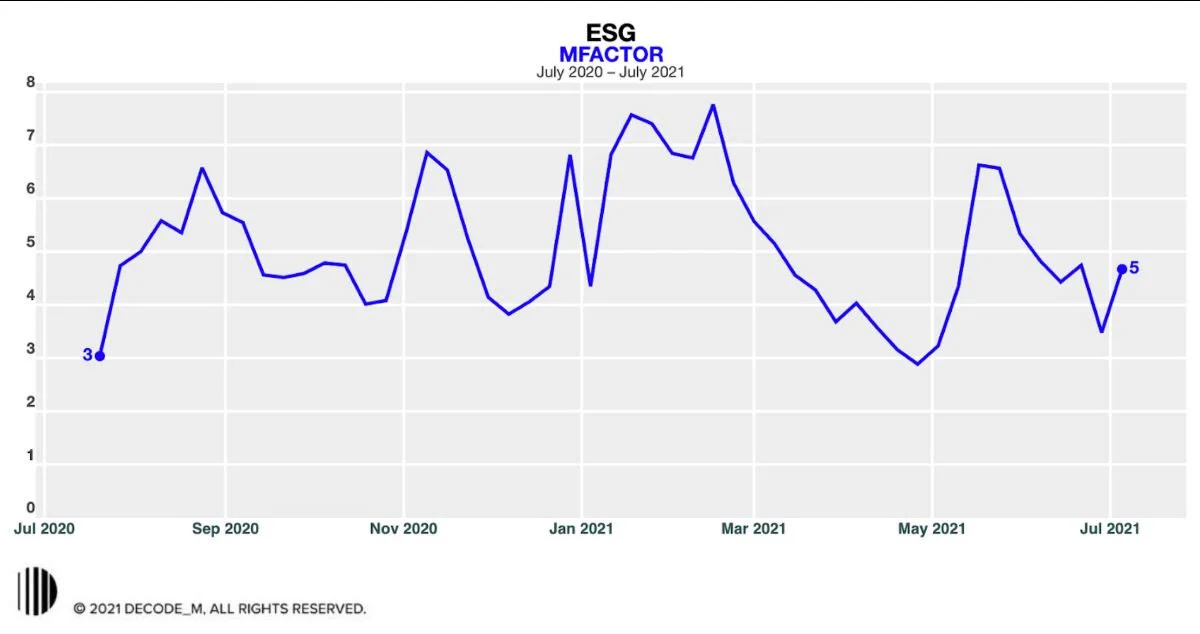

MFactor is a proprietary tool that measures cultural momentum through topic modeling and sentiment analysis.

Now momentum for ESG is on the rise fueled by an evolution in its meaning and a renewed sense of its importance for all companies & organizations across all three elements of Environmental, Social and Governance: increased attention to climate change, increased importance of social movements and consumer & employee demand for purpose & measurable impact beyond products.

The Challenge: Company leaders know they need an Environmental, Social and Governance strategy… But they want to go beyond “compliance” -- they want to use these strategies as a force for business momentum. As companies start using them for strategic advantage, we see three challenges arise with execution:

Statements with no substance: Today’s savvy consumers, employees, prospective employees, partners, investors, etc see through buzz-wordy but empty ESG statements. Companies need tangible & measurable proof of impact to back up their words.

Failure to communicate & connect the dots: Some companies are successfully making an impact - but struggle with how to tailor communications about their ESG initiatives to different stakeholder groups (e.g. consumers, employees, prospective employees, partners, investors). Others are integrating ESG initiatives but don’t clearly communicate how they align with their brand identity and values.

Inconsistent Standards: ESG standards vary across industries and ratings are often biased depending on who created them, making it difficult to compare companies to each other and see ratings in context.

ESG is a Momentum Strategy

ESG can fuel your company’s growth when integrated as a core part of your company’s momentum strategy and aligned with the 5 drivers of momentum. However, consumers are quick to call-out brands who are inconsistently aligned with their own ESG initiatives.

Take the case of Pepsi and Coca Cola. Both companies get high ESG scores from the biggest ratings firms. They are also typically amongst the largest holdings for ESG funds, largely because they rank high on parameters such as corporate governance and greenhouse gas emissions. Consumers call them out because their core businesses involve the manufacturing and marketing of addictive products that are a major cause of diabetes, obesity, and early mortality.

ESG initiatives have the opportunity to shift consumer perception of brands and give companies momentum. You just have to know how to use it.