Crypto Goes Mainstream

The days of people viewing crypto as a curiosity and something that’ll never catch on are long gone.

Crypto is now entering the mainstream, with companies across sectors starting to incorporate it into their businesses. One of the most intriguing ways so far? Crypto loyalty programs.

Brands from Shake Shack to the University of Pennsylvania to the most surprising of all - IHOP - are leaning into the momentum of crypto to increase customer loyalty.

IHOP is playing with the idea through its “PanCoins” rewards program, which gives loyal customers access to the “International Bank of Pancakes” (aka free pancakes!). It’s not technically crypto (yet), but it shows just how popular the idea has become.

It’s not a matter of if crypto is coming to your sector, but when.

Let’s Break It Down:

Cryptocurrency (Crypto): Any digital-only currency that uses cryptography to secure transactions. Payments are made peer-to-peer without relying on banks, existing as recorded entries in an online database.

Crypto Wallet: These store the private keys that allow one to access their crypto on the blockchain. They come in many forms, from USB stick-like hardware to mobile apps.

Blockchain: A digital ledger of transactions duplicated across an entire network of computer systems, making it nearly impossible to hack.

NFTs (Non-Fungible Tokens): A digital asset that represents real-world data (such as artwork, music, event tickets, etc.), stored on a blockchain with a unique identifying code.

WHAT’S UP ⬆️:

Sectors, from financial services to hospitality are incorporating new ways of offering crypto and NFTs, as more and more people seek to dip their toes into digital assets.

EV Hotel: This high-tech Atlanta hotel announced in late February that it’s creating an exclusive NFT membership rewards program for its clients, making it the first hotel to do so.

Stripe: After dropping bitcoin in 2018, the payment platform is diving headfirst back into crypto. Last week, Stripe announced a partnership with crypto exchange FTX and Blockchain.com to supercharge its support of crypto businesses, including new payment channels and improved user identity verification systems.

UPenn: What’s so exciting about crypto now is not just how people and organizations are using it, but who. That’s the case for the University of Pennsylvania, which will start accepting crypto as payment for tuition fees — for one course on, appropriately enough, blockchain. The institution had previously accepted a $5 million donation in Bitcoin.

WHAT’S DOWN ⬇️:

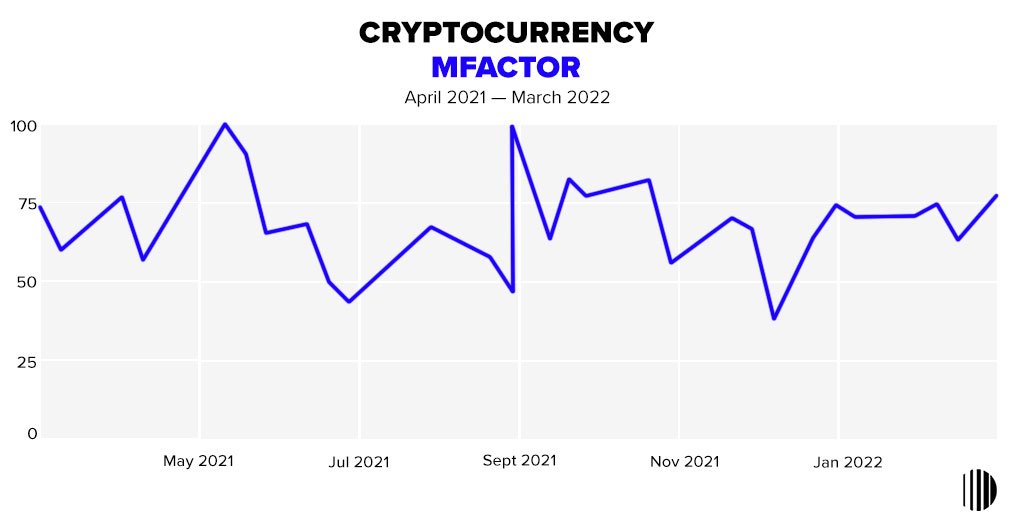

The slow and steady approach to investing, apparently. Crypto is notoriously volatile; while quick gains are a big attraction, there’s also potential for fast, extreme declines in value… like when Bitcoin dropped 50% between April and June 2021.

WHAT’S NEXT ➡️:

| D Disruption |

We’re seeing a big shift in the kinds of companies engaging with crypto. What was once solely the domain of Big Tech has expanded to industries and brands rarely associated with technological innovation. Even governments are adopting it: in September, El Salvador became the first country to use Bitcoin as legal tender, and the United States began the first Bitcoin Exchange Traded Fund in October. |

| I Innovation |

Shake Shack has always been at the forefront of innovation in the food industry. Now, it’s testing a loyalty promotion that offers Bitcoin as a reward for purchases made in Cash App. Shake Shack has seen demand from guests to pay with crypto increase, and the chain hopes the program will be a stepping stone to accepting it as a form of payment. |

| P Polarization |

Despite being more mainstream than ever before, investing in cryptocurrency is risky: there is a high chance of losing money. For people who aren’t comfortable with or aren’t in the position to take these risks, it’s still best to stay away. |

| S Stickiness |

In some ways, the security inherent to crypto and its advantages as a digital currency make it even more vulnerable… to human error. If you forget your password or damage your crypto wallet’s hard drive, for example, you’re SOL. Bye-bye, $550 million! |

| S Social Impact |

Crypto allows for greater accessibility and flexibility in business transactions. Its wider adoption could reshape global markets, especially for international transactions that until now have been rooted in USD.

We’re seeing this global impact play out in real time. On one hand, the “borderless” currency has crashed into the thorny realities of geopolitical conflict after Russia’s invasion of Ukraine. On the other, Ukraine adopted a new law recognizing and regulating virtual assets this Wednesday in response to an outpouring of crypto donations. |